The Web3 space, with its decentralized platforms and innovative digital assets like NFTs, has become a magnet for investors and traders seeking new opportunities. However, with the rise of these opportunities comes the risk of getting “rugged” — a term used to describe a scam where developers abandon a project and run away with investors’ funds. This article aims to help you navigate the Web3 space safely, providing samples of common rug pulls and solutions to avoid them.

Understanding Rug Pulls

A rug pull typically involves the following:

- Fake Projects: Developers create a project with no intention of following through.

- Liquidity Withdrawal: Developers remove all liquidity from the market, causing the token value to plummet.

- Sudden Abandonment: Developers suddenly disappear after collecting funds from investors.

Common Web3 Rug Pull Scenarios

1. The Pump and Dump Scheme

-

- Scenario: A new token is heavily promoted, leading to a rapid increase in price. Once enough investors buy in, the creators sell off their holdings, causing the price to crash.

- Example: Token XYZ is launched with a lot of hype. Early investors see quick gains, but soon after, the creators sell all their tokens, crashing the market.

2. Fake NFT Projects

-

- Scenario: Developers create a seemingly legitimate NFT project, sell the NFTs to investors, and then abandon the project, leaving buyers with worthless assets.

- Example: An NFT collection named “Digital Art Masters” promises exclusive benefits but vanishes after selling out, with no roadmap or support.

3. Deceptive Smart Contracts

-

- Scenario: Malicious code is hidden in the smart contract, allowing creators to drain funds from investors’ wallets.

- Example: A staking platform offers high returns, but the smart contract includes a hidden function that transfers users’ funds to the developer’s address.

How to Avoid Rug Pulls

1. Conduct Thorough Research

- Verify Team Credentials: Ensure the project team has a verifiable and reputable background. Look for LinkedIn profiles, previous projects, and community presence.

- Check Project Roadmap: Legitimate projects typically have a clear and detailed roadmap. Avoid projects that lack a solid plan or make unrealistic promises.

2. Analyze the Smart Contract

- Audit Reports: Look for third-party audit reports from reputable firms. These audits can reveal vulnerabilities or malicious code in the smart contract.

- Open Source Code: Prefer projects with open-source code that can be reviewed by the community.

3. Evaluate Community and Social Media Presence

- Engaged Community: Projects with an active and engaged community are less likely to be scams. Check forums, social media channels, and community discussions.

- Transparency: Legitimate projects maintain regular updates and communication. Be wary of projects with little to no transparency.

4. Examine Tokenomics

- Liquidity Lock: Ensure a significant portion of the liquidity is locked for a specified period. This prevents developers from withdrawing all funds suddenly.

- Distribution: Analyze token distribution to avoid projects where the majority of tokens are held by the developers.

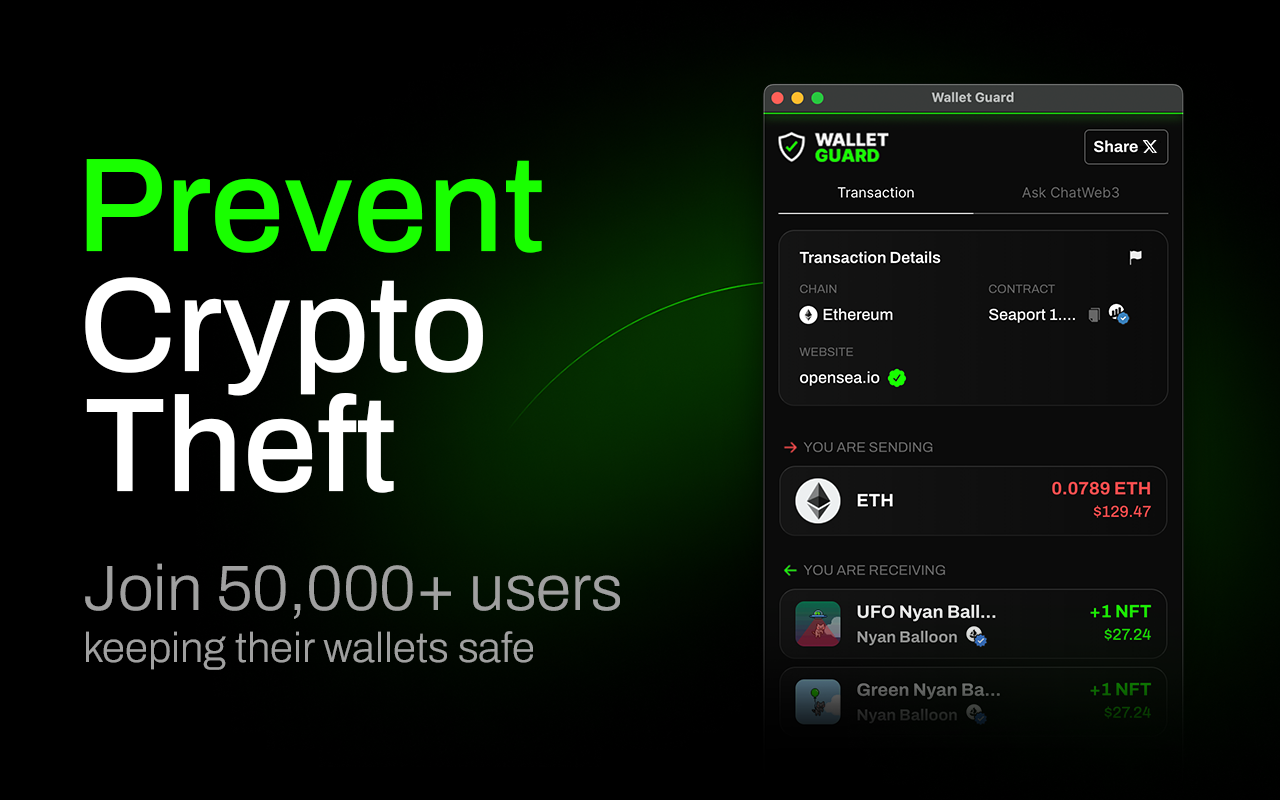

5. Protect your digital wallet with Wallet Guard

- The most advanced open-source browser extension that identifies scams & wallet drainers before they interact with your preferred wallet.

- Proactively detect phishing scams & attempts to mimic real websites

- Get warnings while transacting so you can proceed with confidence

Solutions for Safe Investing

Use Trusted Platforms

- Reputable Exchanges: Stick to well-known and reputable exchanges for buying and trading tokens.

- Verified NFT Marketplaces: Use verified and established NFT marketplaces to avoid fake projects.

Diversify Investments

- Spread your investments across multiple projects to minimize risk. Avoid putting all your funds into a single project.

Stay Informed - Keep up with the latest news, updates, and trends in the Web3 space. Follow trusted sources and influencers who provide valuable insights.

Employ Security Best Practices

- Use Hardware Wallets: Store your assets in hardware wallets for better security.

- Enable Two-Factor Authentication: Use 2FA on all accounts to add an extra layer of security.

- Download browser extension to protect your digital wallet with Wallet Guard

Navigating the Web3 space requires vigilance and due diligence. By understanding common rug pull scenarios and implementing the solutions provided, you can significantly reduce the risk of falling victim to scams. Always remember, if something seems too good to be true, it probably is. Stay informed, stay secure, and make educated decisions to thrive in the Web3 ecosystem.